Deksu independently designed four characteristic logistics services, Airfreight, Ocean Freight& Express, Ocean Freight& Trucking, and Courier Service

Deksu FBA Airfreight Service is a special line product designed by ourselves, offers clearance, and delivers to the United States, Canada, European FBA warehouses, and third-party overseas warehouses or private addresses by UPS/FedEx/DPD. Our company has signed a contract with European and American airlines for fixed cabins, guaranteeing storage space and timeliness. Cooperate with a number of high-quality courier companies, with end-point truck delivery to form multi-level multi-network channels.

Deksu FBA Ocean Freight & Express Service is also a special line product designed by ourselves, transported to the destination country overseas warehouse sorting, and delivers to the United States, Canada, Europe FBA warehouses and third-party overseas warehouses or private addresses by UPS/FedEx/DPD. We've established a long-term partnership with shipping companies such as EMC, ZIM, MATSON, MSC, CMA, with sufficient space. We choose American company as a regular importer, with compliance clearance, and strict category review to ensure your goods are safe and convenient, achieving high customs clearance rate and low inspection rate.

Deksu FBA Ocean Freight & Trucking Service is a product designed by ourselves based on the different characteristics of FBA warehouses in Europe and America. It includes pallet direct delivery to warehouses in US and CA, direct delivery from European-supervised warehouses, and mature and compliant deferred shipping with customs clearance and truck delivery service to the Netherlands and Belgium. We build our own fleet and truck agents cover the delivery network, familiar with FBA warehousing rules, low cost, fast warehousing, high flexibility, can efficiently cooperate with customer needs.

Deksu E-commerce Logistics is one of the UPS/DHL/FedEx/TNT express agents, with standardized operation, powerful system, reasonable price, and sufficient storage space, effectively helping customers solve the pain points of FBA fast replenishment.

The excellent channel-Matson Ocean Freight Limited Time Delivery Service will pay out when delay. Covering eight popular FBA warehouses in the United States ONT8 LAX9, LGB8, SMF3, LAS1, GYR3, FTW1, GYR2

1. Delivery within 9 working days at the fastest

2. Pay 1 yuan for one day of delay until the freight is paid out

3. Priority cabin, priority delivery

4. Time-limited delivery

Covering 180+ FBA warehouses across the United States, delivery within 30 days of sailing across the United States, with a success rate of over 97.2%.

FBA warehouse:XIX6/LGB6/LGB3/LGB4/SNA4/XLX2/SBD2/SBD3/LGB9/ONT2/ONT6/ONT9/KRB1/KRB4/QXY9/KRB7/LAS6/LAS7/FAT1/FAT2/SJC7/OAK3/SCK1/SCK3/MDW8/HOU8

SMF7/AZA4/PHX3/PHX5/PHX7/PHX6/SMF6/OAK4/SMF1/MCE1/RNO4/SLC2/SLC3/SAT3/SAT4/DFW6/FTW2/FTW3/FTW5/FTW6/FTW9/FTW1/SAT1/SAT2/BOI2

BFI3/PDX6/PDX7/PDX9/DEN1/DEN2/DEN7/DEN8/BFI7/OLM1/GEG2/DAL2/DAL3/HOU2/HOU3/HOU7/SAT6/SATI/TUL2/OKC2/OKC3/MEM1/MDW2/MDW1/MDW6

MDW9/GEG2/IND9/ICT2/FOE1/MKC4/STL8/STL3/LIT1/LFT1/MEM6/MEM8/BNA2/CHA2/CHA1/JVL1/MKE1/HSV1/ORD2/IGQ2/XLX1/STL6/STL4/SDF1/CVG1/FWA4

SDF8/IND1/IND2/IND4/IND5/MQJ1/MQJ2/ORD2/FWA4/LIT2/MGE1/MGE3/SAV3/CSG1/ATL8/MGE3/CMH2/CMH3/CMH6/DET1/DET2/DTW3/CAE1/GSP1/CLT2

CLT3/CLT4/CLT6/GSO1/JAX3/JAX2/TPA3/RIC1/RIC2/RIC3/ATL2/ATL3/TPA6/TPA2/MCO1/MCO2/PBI2/KRB2/BWI4/BWI2/DCA1/DCA6/HGR2/MDT2/PHL6/PHL5

MDT1AVP1/ABE3/ABE2/AVP9/ABE4/AVP3/PIT2/TEB3/TEB4/ABE8/XIX1/EWR4/ACY2/TEB6/TTN2/TEB9/SWF1/ALB1/ILG1/PHL7/BDL6/BOS7/PHL5/DTW1/AWD IUSL

Walmart Warehouse:LAX1/LAX2/PHX1

Overseas Warehouse: WINIT West Warehouse, CA 91789 / WINIT West Warehouse, CA 91748 / GOODCANG Meixi 1, CA 90022 / CITY OF INDUSTRY, CA 91745 Overseas Warehouse / Orange Connex West Warehouse / Anaheim, CA 92806 Overseas Warehouse / Ontario, CA 91761 Overseas Warehouse / Chino, CA 91710 Overseas Warehouse

1. Stable timeliness, delivery within 30 days across the United States

2. Not easy to lose the goods, the whole board deliver to the warehouse, loss rate has been 0 since it was opened

3. Strong reservation ability, self-owned fleet operation

4. Satisfy the warehouse distribution of more than 70% of the shipment creation

The UK self-tax VAT ocean freight and trucking service, after arriving at the port, will carry out bonded warehouse customs clearance, ensuring DPD pickup or truck pickup within 7 working days, and the completion rate is over 93.6%.

1. Southampton bonded warehouse free resources, local Chinese team docking throughout the process

2. Pick up the goods in the bonded warehouse of the DPD free account, seamless docking without transfer to the ordinary warehouse for pickup

3. Local customs clearance team with more than 20 years of experience, domestic professional pre-examination of customs information to control risks

4. Support PVA compliant customs clearance and improve the utilization rate of operating funds for sellers

CA Ocean Freight Tax Package Service, direct ship to Vancouver, the earliest pick-up after the sailing half a month, the completion rate is over 87.6%.

1. The fastest voyage is 14 days, with less fixed space, and fast express delivery

2. The whole process takes 16-18 days to realize the network delivery of express pick-up trucks

3. Vancouver's local 50,000-square-foot warehouse, efficient operation, fast delivery

| Division code for the western United States - the first division of the western United States (LAX) | |||

|---|---|---|---|

| FBA warehouse code | State | city | Zip Code |

| ONT2 | CA | California | 92408 |

| ONT6 | CA | California | 92551 |

| ONT8 | CA | California | 92551 |

| ONT9 | CA | California | 92374 |

| LGB3 | CA | California | 91752-5087 |

| LGB4 | CA | California | 92374 |

| LGB6 | CA | California | 92518-1513 |

| LGB8 | CA | California | 92376 |

| DLA4 | CA | California | 91311 |

| SNA4 | CA | California | 92376-3009 |

| District Code for West America Area——West Area One (OAK) | |||

|---|---|---|---|

| FBA warehouse code | State | city | Zip Code |

| SJC7 | CA | Auckland | 95391 |

| OAK3 | CA | Auckland | 95363-8876 |

| OAK4 | CA | Auckland | 95304 |

| SMF1 | CA | Auckland | 95837 |

| SMF3 | CA | Auckland | 95206-8202 |

| Division code for the western United States - the second area of the western United States | |||

|---|---|---|---|

| FBA warehouse code | State | city | Zip Code |

| PHX3 | AZ | Arizona | 85043 |

| PHX5 | AZ | Arizona | 85338 |

| PHX6 | AZ | Arizona | 85043 |

| PHX7 | AZ | Arizona | 85043 |

| TFC1 | AZ | Arizona | 85043 |

| IVSE | NV | Nevada | 89115-3467 |

| IVSF | NV | Nevada | 89115-3477 |

| LAS2 | NV | Nevada | 89030 |

| LAS6 | NV | Nevada | 89115 |

| DEN2 | CO | Colorado | 80019 |

| RNO1 | NV | Nevada | 89408 |

| RNO4 | NV | Nevada | 89506 |

| FAT1 | CA | California | 93725-9588 |

| UCA1 | CA | Francisco | 94112 |

| Division code for the western United States - the third district of the western United States | |||

|---|---|---|---|

| FBA warehouse code | State | city | Zip Code |

| BFI1 | WA | Washington State | 98390 |

| BFI3 | WA | Washington State | 98327 |

| BFI4 | WA | Washington State | 98032 |

| BFI7 | WA | Washington State | 98390 |

| SEA6 | WA | Washington State | 98144 |

| PDX9 | OR | Oregon | 97060 |

| US East Area Partition Code - US East District 1 | |||

|---|---|---|---|

| FBA warehouse code | State | city | Zip Code |

| SDF8 | IN | Indiana | 47130 |

| IVSC | NJ | New Jersey | 08066-1743 |

| TEB3 | NJ | New Jersey | 08085 |

| TEB6 | NJ | New Jersey | 08512 |

| EWR4 | NJ | New Jersey | 08691 |

| EWR5 | NJ | New Jersey | 07001 |

| EWR9 | NJ | New Jersey | 07008-3529 |

| ABE2 | PA | Pennsylvania | 18031 |

| ABE3 | PA | Pennsylvania | 18031 |

| ABE4 | PA | Pennsylvania | 18045 |

| ABE5 | PA | Pennsylvania | 17112 |

| ABE8 | NJ | 宾夕法尼亚州 | 08518 |

| US East Area Partition Code - US East II | |||

|---|---|---|---|

| FBA warehouse code | State | city | Zip Code |

| VUBA | PA | Pennsylvania | 18512 |

| MDT1 | PA | Pennsylvania | 17015 |

| MDT2 | MD | Maryland | 21901 |

| AVP1 | PA | Pennsylvania | 18202 |

| AVP3 | PA | Pennsylvania | 18202 |

| PHL5 | PA | Pennsylvania | 17339 |

| PHL6 | PA | Pennsylvania | 17015 |

| JFK8 | NY | New Jersey | 10314 |

| ACY1 | NJ | New York | 8066 |

| BDL1 | CT | Connecticut | 6095 |

| ATL6 | GA | Georgia | 30344-5707 |

| VUAT | GA | Georgia | 30291 |

| MGE3 | GA | Georgia | 30549 |

| ATL8 | GA | Georgia | 30122-3895 |

| JAX3 | FL | Florida | 32221 |

| JAX2 | FL | Florida | 32218-2432 |

| CLT2 | NC | North Carolina | 28214-8082 |

| CAE1 | SC | South Carolina | 29172 |

| GSP1 | SC | South Carolina | 29303 |

| US-Central Area Code - US-Central District 1 | |||

|---|---|---|---|

| FBA warehouse code | State | city | Zip Code |

| FTW1 | TX | Texas | 75241-7203 |

| FTW2 | TX | Texas | 76051 |

| FTW6 | TX | Texas | 75261 |

| DFW6 | TX | Texas | 75019 |

| MDW2 | IL | Illinois | 60433-3280 |

| MDW4 | IL | Illinois | 60433 |

| MDW6 | IL | Illinois | 60446-6529 |

| MDW7 | IL | Illinois | 60449 |

| MDW8 | IL | Illinois | 60085 |

| MDW9 | IL | Illinois | 60502 |

| US-Central Zoning Code - US-Central II | |||

|---|---|---|---|

| FBA warehouse code | State | city | Zip Code |

| IND1 | IN | Indiana | 46075 |

| IND2 | IN | Indiana | 46168 |

| IND3 | IN | Indiana | 46168 |

| IND4 | IN | Indiana | 46231 |

| IND5 | IN | Indiana | 46168 |

| IND6 | IN | Indiana | 47130 |

| XUSE | IN | Indiana | 46075 |

| DET1 | MI | Michigan | 48150 |

| DTW1 | MI | Michigan | 48174 |

| DFW7 | TX | Texas | 76177 |

| SAT1 | TX | Texas | 78154 |

| DFW1 | TX | Texas | 75261 |

| XUSB | TX | Texas | 76155 |

| SAT2 | TX | Texas | 78666-8969 |

| HOU2 | TX | Texas | 77038-2324 |

| HOU3 | TX | Texas | 77423 |

| ITX1 | TX | Texas | 77064-3329 |

| ITX2 | TX | Texas | 77040-1437 |

| US-Central Zoning Code - US-Central II | |||

|---|---|---|---|

| FBA warehouse code | State | city | Zip Code |

| SDF8 | IN | Indiana | 47130 |

| MEM1 | TN | Tennessee | 38118-8102 |

| MKC6 | KS | Kansas | 66102-3047 |

| MKC4 | KS | Kansas | 66021-9588 |

| TUL1 | KS | Kansas | 67337 |

| STL4 | IL | Illinois | 62025-2815 |

| CVG1 | KY | Kentucky | 41048 |

| CVG2 | KY | Kentucky | 41048 |

| CVG3 | KY | Kentucky | 41048 |

| CVG5 | KY | Kentucky | 41048 |

| IVSA | KY | Kentucky | 41048 |

| IVSB | KY | Kentucky | 41048 |

| LEX1 | KY | Kentucky | 40511 |

| LEX2 | KY | Kentucky | 40511 |

| SDF1 | KY | Kentucky | 42718 |

| SDF2 | KY | Kentucky | 40218 |

| SDF4 | KY | Kentucky | 40165 |

| SDF6 | KY | Kentucky | 40165 |

| SDF7 | KY | Kentucky | 40165 |

| SDF9 | KY | Kentucky | 40165 |

| MKE1 | WI | Wisconsin | 53144 |

| CMH1 | OH | Ohio | 43018 |

| CMH2 | OH | Ohio | 43125-9016 |

| District code for the Eastern United States——Third District of the Eastern United States | |||

|---|---|---|---|

| FBA warehouse code | State | city | Zip Code |

| BWI2 | MD | Maryland | 21901 |

| BWI4 | VA | Virginia | 22624-1568 |

| RIC1 | VA | Virginia | 23803 |

| RIC2 | VA | Virginia | 23836 |

| XUSC | PA | Pennsylvania | 17013 |

| BOS1 | NH | New Hampshire | 03063 |

| BOS5 | MA | Massachusetts | 02072 |

| BOS7 | MA | Massachusetts | 02722 |

| PHL1 | DE | Delaware | 19720 |

| PHL3 | DE | Delaware | 19720 |

| PHL4 | PA | Pennsylvania | 17015 |

| PHL7 | DE | Delaware | 19709 |

| PHL8 | DE | Delaware | 19709 |

| UFL3 | FL | Florida | 33605 |

| UFL4 | FL | Florida | 32819 |

| MCO1 | FL | Florida | 32824 |

| TPA1 | FL | Florida | 33570 |

| TPA2 | FL | Florida | 33811 |

| CLT3 | NC | North Carolina | 28027-7995 |

| CHA1 | TN | Tennessee | 37416 |

| CHA2 | TN | Tennessee | 37310 |

| BNA1 | TN | Tennessee | 37090 |

| BNA2 | TN | Tennessee | 37067 |

| BNA3 | TN | Tennessee | 37127 |

| BNA4 | TN | Tennessee | 37217 |

It is the golden time to prepare for the peak season. Unexpectedly, there are frequent "typhoons" and "earthquakes" in the cross-border circle: The Sino-US trade war continues to escalate. Starting from September 24, 2018, the US government will implement a 200 billion import from China U.S. dollar goods are subject to additional tariffs at a rate of 10%, and the tariff rate will be increased to 25% from January 1 next year. The U.S. government is pressing harder and harder, and China is also counterattacking again and again. However, if the two sides fight, there must be casualties! I believe that foreign trade companies and cross-border e-commerce companies can't sit still. Will my products be included in the US tax increase list? How much tax will be added? Today, Xiaode chatted with everyone and talked about how to break through these problems.

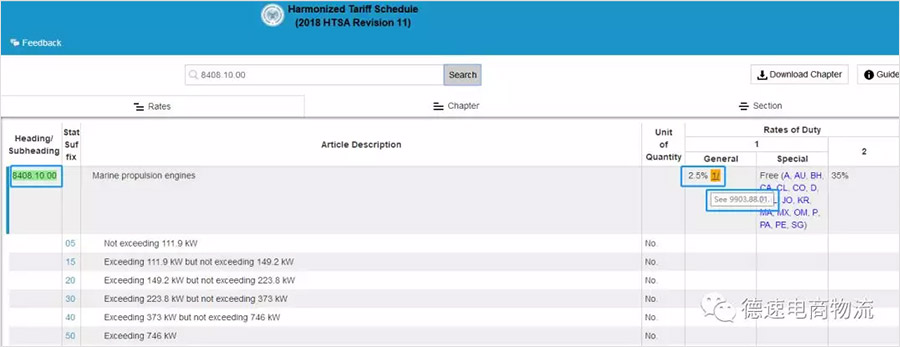

Click the official website of "U.S. Customs Tariff Inquiry": http://www.usitc.gov/tata/hts/bychapter/index.htm, enter the Chinese HS CODE in the search box under Search the current Harmonized Tariff Schedule... under Tariff Assistance The first six digits, such as desk lamp 940520****, there is a detailed HTS on the left frame of the search result page CODE, choose HTS CODE according to your own product.

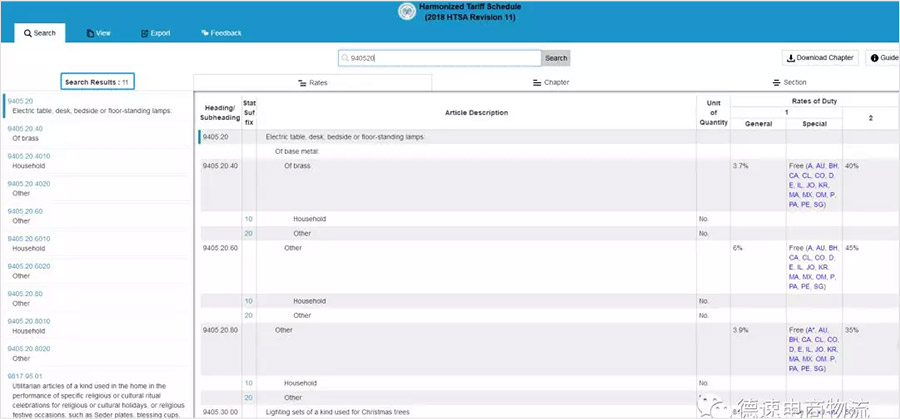

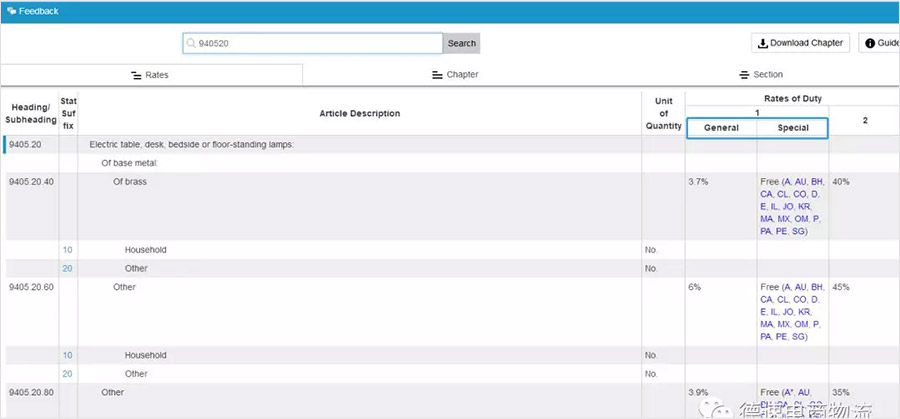

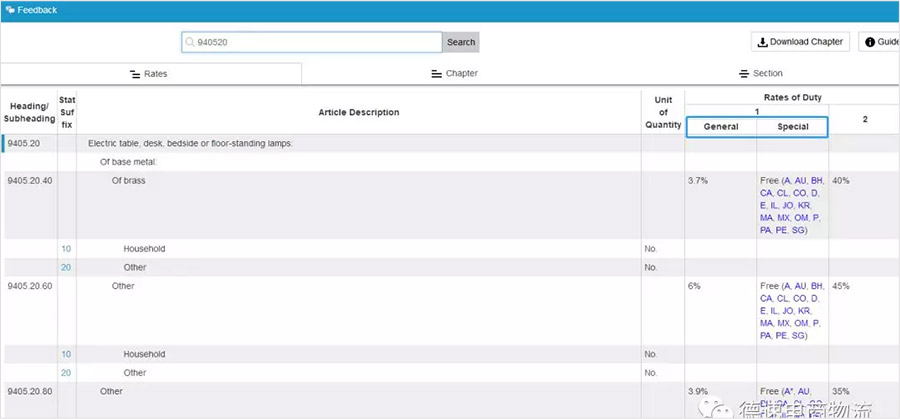

In the search page, "General" on the left column of Rates of Duty 1 is the general import tax rate, and "Special" on the right column is the import tax rate imposed by the United States on specific countries.

At present, some foreign traders have encountered the situation that the goods arrived in the United States, and the buyer discovered that they had to pay a 25% tariff. In the end, the buyer chose to abandon the goods, and the exporter had to deal with follow-up matters such as return of the goods. torment.

Therefore, Xiaode reminds everyone that when exporting to the United States, remember to take the initiative to check whether the product is included in the taxation list, and contact the American buyer to verify the situation. Whether it is an order under DDP terms or an Amazon operation in the United States, it is necessary to confirm the customs clearance tariff in the United States in advance. It is very likely that the export tariff last month will be very different from this month's tariff.

For specific products, you can see that there are several columns in the "Rates of Duty", which column should you look at?

"General" in "1" refers to the tariffs of most imported products from the world (including China), "Special" Refers to the import tariffs of countries that have relevant free trade agreements with the United States (often free, but that is not for us to enjoy);

"2" refers to trade restrictions that have no trade relationship with the United States

Import duties for special countries (such as North Korea).

So, we are looking at the "General" tax rate.

At this time, many people want to ask: The "General" tax rate has not changed, and 25% has not been added. Does this mean that the product has not been taxed in the end?

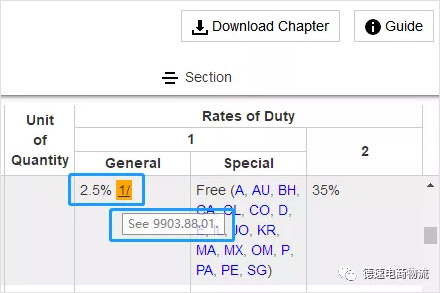

Please pay attention to whether there is a "1" after your "General".

Xiaode will give you a chestnut to explain: we will use the marine propulsion engine with the tax number "8408.10.00" as an example to demonstrate. This product has been included in the $16 billion tax increase list. "General" shows 2.5%. But it is followed by a "1", which means let's look at the subtitle "9903.88.01".

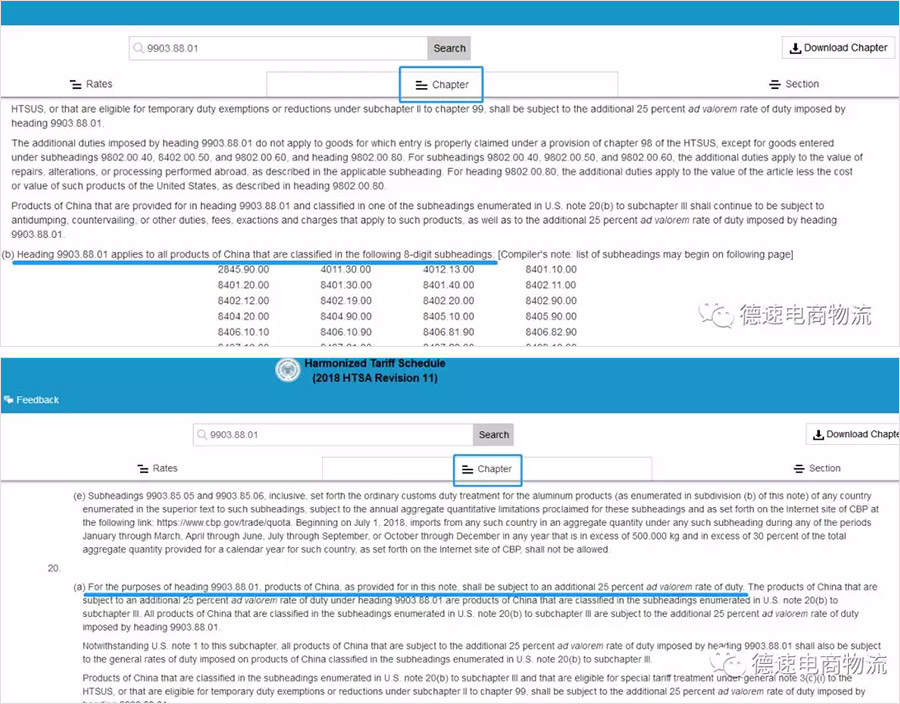

Continue to search for "9903.88.01" on the webpage, and it is clearly mentioned here that this part of Chinese products is subject to an additional 25% on the basis of the applicable tax rate.

Articles the product of China, as enumerated in U.S. note 20 to this subchapter.

The duty provided in the applicable subheading plus 25%.

What is "note 20" mentioned in this sentence? Under the "Chapter" page, I found this note 20, which is an explanation for the tax increase on Chinese products. It is clearly stated here that 25% is an additional tax rate. The codes grouped under "9903.88.01" also continue to be listed below.

Some friends may say: I checked my product, and there is no note with "1" after "General". Is this a tax increase or not? I tried it, and it is true that some products do not show tax increases, but they are in the PDF list. I suggest that you still refer to the PDF list. What if the official website of the United States has not updated the data yet?

Finally, Xiaode suggests that everyone: first check the HTS code in the three PDF files for download to see if the product has been shot; The URL mentioned above) to check the tax rate; or reconfirm with the buyer who ordered whether the product will be subject to tax.

The Sino-US trade war continues to escalate, and the policies of old e-commerce platforms continue to be tightened. Many cross-border sellers are already struggling. However, the United States is now imposing an additional 25% tariff. Doesn’t this cut off our way of life? But everyone should not be too pessimistic, because our country and government will not let it go. On the morning of September 25, the State Council Information Office held a press conference to discuss the previously released "Facts About Sino-US Economic and Trade Friction and China's Position." "White Paper for Interpretation. The press conference made it clear that the so-called "the theory that the United States suffers losses" is untenable. The United States will further impose tariffs on goods worth 200 billion U.S. dollars, which will have a direct and indirect impact on the Chinese economy, and individual industries and regions will be more affected. . However, the risks are generally controllable, and the Chinese economy is fully capable of hedging the impact by expanding domestic demand and promoting high-quality development. It is believed that the Chinese government will also formulate a series of policies in favor of foreign trade enterprises and cross-border e-commerce enterprises.

The European Union started from the European Community and has developed from the initial 6 member states to 28 member states. With the gradual deepening of the integration process of the European Union, a multi-dimensional integration of customs, markets, currency and politics has formed. Customs-border integration means that the allied countries implement common tariff rates and foreign trade policies for the import of goods from countries or regions outside the customs border. A major convenience brought about by customs-border integration is that the tariff rate for goods imported into the EU is the same, and there will be no tariff/value-added tax for the circulation of goods between the allied countries after entry.

*Note: Only the import tax rate of products is unified in the customs union. Although Europe also has a unified VAT collection rule, the VAT rate is not unified across countries.

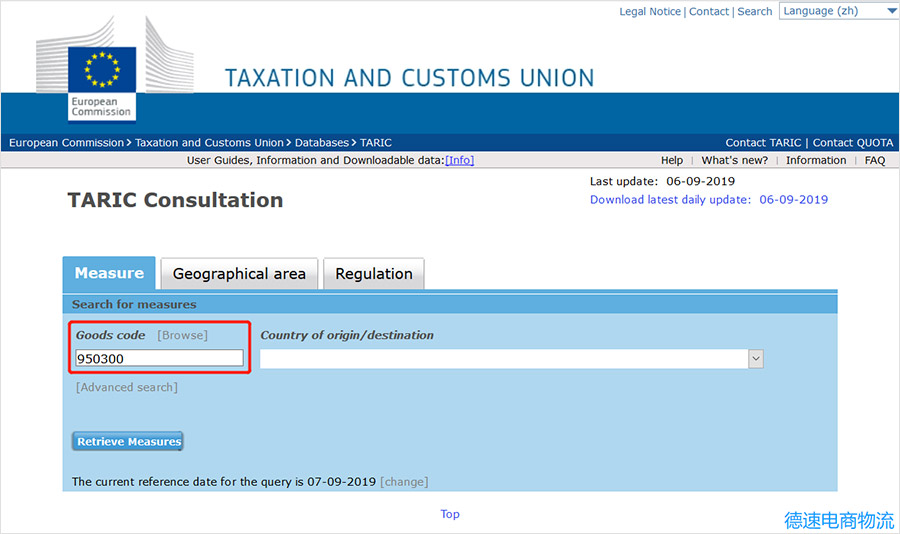

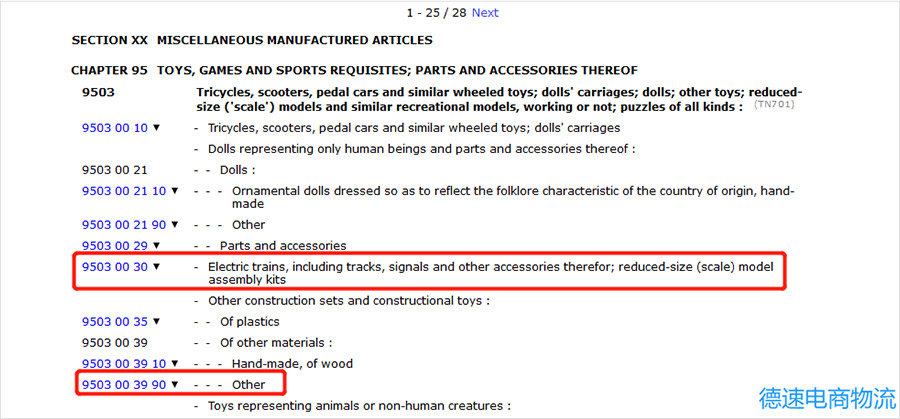

Open TARIC CONSULTATION official website: http://ec.europa.eu/taxation_customs/dds2/taric/taric_consultation.jsp, enter the first six digits 950300 location (Because the EU customs code is the same as the tax rate, so Country of origin/destination can be left blank)

Confirm the final customs code according to the TARIC rules. Here you must check it according to the detailed description of the sub-objective, otherwise the corresponding tax rate may be very different.

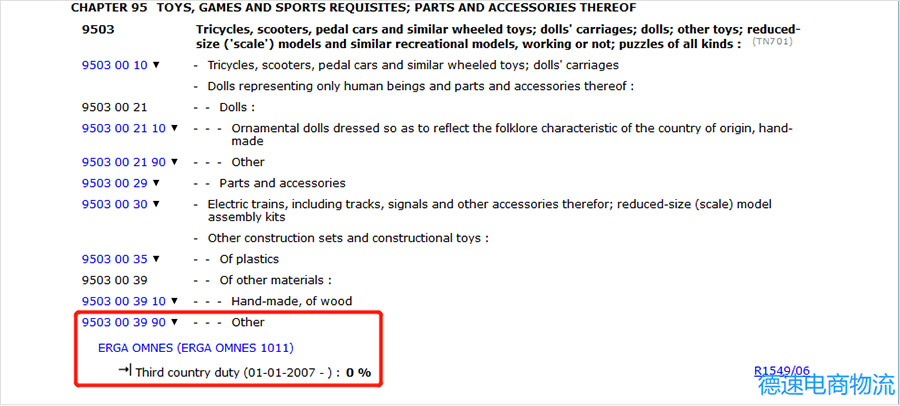

Click on the final confirmed TARIC CODE, you can see that the tax rate of drones in the EU is still 0%

Similar to the HTS official website in the United States, you can see that the tax rate is divided into many levels. The one applicable to China is ERGA OMNES (that is, the universally applicable level), followed by the preferential tax rates of other countries.

In 2018, according to the policies of European countries, in the UK, Amazon needs to consider value-added tax (VAT) if merchants sell goods or provide services to the UK and Europe, or import goods from abroad to the UK and Europe.

Merchants need to register a value-added tax number (VAT number) with the British Revenue and Customs Administration (HMRC), make quarterly declarations as required, and pay taxes.

The specific calculation is divided into two parts: import and sales.

Import tax = import value-added tax + import tariff

Import value-added tax = (declared value-added tax + first-leg freight + tariff) X 20% (this can be returned by merchants)

Import tariff = declared value X product tax rate

Sales VAT = Pricing (price before tax) X 20%

Market sales price (tax included) = Pricing (price before tax) + Sales VAT = Pricing (price before tax) + Pricing (price before tax) X 20%= Pricing (pre-tax price) X 1.2

In other words, sales value-added tax = market sales price / 1.2 X 20% = market sales price / 6 (the VAT paid is actually 1/ of the market price 6)

Example:

Declared value: 100.00

Shipping: 10.00

duty: (100×0.03)=3 (tax rate 3%)

Payable import VAT=(100+10+3)×20%=22.60

Total cost of goods: 100+10+22.6+3=135.60

Example:

Sales price: 250.00

Sales price excluding tax: 250.00÷(1+20%)=208.4

Sales VAT=250.00÷(1+20%)×20%=41.7

Actual scene:

A certain type of shoes is sent to the UK, the quantity is 200 pairs, and the declared value is 20 pounds per pair. Then, the total declared value of this batch of shoes is 4,000 pounds, the total freight for the first leg is 500 pounds, and the shoe tax rate is 10%. Final sale price (tax included) on eBay is £100/pair. So, how much VAT (value-added tax) does the merchant actually need to pay in the current season?

Tariff = declared value of goods X commodity tax rate = 4000 * 10% = 400 pounds X 20% = £980

2) Sales VAT calculation:

If these shoes are sold online in the current season, and the final sales price is 100 pounds per pair, the actual sales may occur in the following situations:

A. The number of shoes sold is 0. That is, the sales volume is 0, and the sales VAT is 0. The seller can apply for a tax refund (import VAT) of 980 pounds from HMRC;

B. All 200 pairs of shoes are sold. That is, the sales volume is 20,000 pounds, the sales value-added tax is 20,000/6=3333.3 pounds, and the payable VAT (value-added tax) is 3333.3-980=2353.3 pounds;

C. Only part of the shoes are sold, such as Half, that is, 100 pairs, then the sales are 10,000 pounds, the sales value-added tax is 10000/6=1666.6 pounds, and the VAT (value-added tax) payable is

1666.6-980=£686.6;

D. If only 50 pairs of shoes are sold, the sales value-added tax at this time is 50*100/6=833.3. At this time, the sales value-added tax is lower than the import value-added tax of 980 pounds, and VAT (value-added tax) should be paid at this time Tax) is

833.3-980=-146.7 pounds. In other words, at this time, after deducting the VAT, the UK Revenue and Customs Administration will refund you 146.7 pounds.

The British government announced that it will implement the Fulfillment House Due Diligence Scheme for warehouse service providers from April 1, 2018.

The Act applies to UK service providers who import goods from outside the EU and provide storage services in the UK for businesses outside the EU (that is, overseas warehouses that provide storage services to overseas sellers , are applicable to this bill).

The Act requires eligible warehousing service providers to register with HM Revenue & Customs and conduct strict due diligence on their overseas customers (for example, whether the customer has a valid UK Value Added Tax (VAT) number ); If overseas customers who may not comply with the regulations are found, they must stop cooperating with these customers and inform the HM Revenue and Customs of the relevant information.

1) Service providers who have carried out the above business before 2018/4/1 must register with the UK Revenue and Customs before 2018/6/30.

2) Service providers who carry out the above business on or after 2018/4/1 must register with HMRC before 2018/9/30.

Sellers need to pay attention! After the implementation of this regulation, non-compliant warehousing service providers will no longer be able to provide overseas warehouse services. A few very mature tips for sellers:

1) Find a compliant and registered warehousing service provider (HMRC will publish the registration list).

2) Provide the required information to the warehousing service provider, such as: compliant UK value-added tax (VAT) number, and cargo information, etc.

3) Ensure timely declaration and payment of value-added tax (VAT) in accordance with relevant regulations.